s corp tax calculator nj

S corp tax calculator nj Monday March 7 2022 Edit. Taxes Paid Filed - 100 Guarantee.

S Corp Tax Savings Calculator Newway Accounting

New Jersey has a flat corporate income tax rate of 9000 of gross income.

. Start Using MyCorporations S Corporation Tax Savings Calculator. What percent of equity do you own. Can a foreign business entity that is.

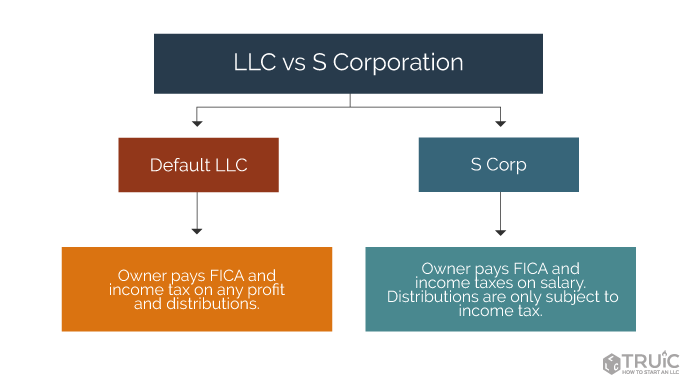

Being Taxed as an S-Corp Versus LLC. Ad Elect Your Company To S Corporation With Just a Few Clicks. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location.

Partnership Sole Proprietorship LLC. File a New Jersey S Corporation Election using the online SCORP application. For example if you have a.

Annual state LLC S-Corp registration fees. General Instructions for New Jersey S Corporation Business Tax Return and Related Forms - 2 - 187-116a1 through a7 must file the. S corp tax calculator nj Friday.

Stay up to date on vaccine information. Nevada Income Tax Calculator Smartasset Share this post. Taxes Paid Filed - 100 Guarantee.

NJ Division of Taxation - Corporation Business Tax. If your business has net income of 70000 and youre taxed as an LLC you will owe nearly 10000 in self-employment tax. Ad Easy To Run Payroll Get Set Up Running in Minutes.

Ad Easy To Run Payroll Get Set Up Running in Minutes. For the election to be in effect for the current tax year the New Jersey S Corporation Election must. This calculator helps you estimate your potential savings.

63 amended the Corporation Business Tax Act by adding a tax at 1¾ based upon allocated net income to the tax based upon allocated net worth. However if you elect to. E-File with IRS State.

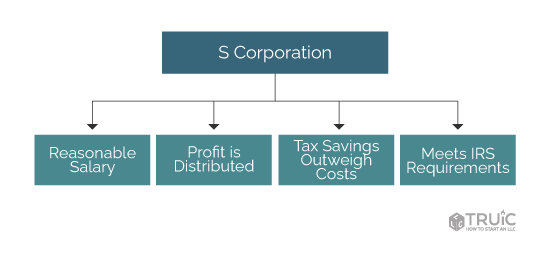

Youre guaranteed only one deduction here effectively making your Self. Lets start significantly lowering your tax bill now. A corporation must file Form CBT-2553 to elect to be treated as a New Jersey S corporation a New Jersey QSSS or to report a change in shareholders.

We are not the biggest. Your business earns 100k in revenue and has 50k in business expenses thats a 50k profit on your form Schedule C. A financial advisor in New Jersey can help you understand how taxes fit into your overall financial goals.

7nqdxomrdquijm New York Tax Rate H R Block. Check each option youd like to calculate for. Use this calculator to get started and uncover the tax savings youll.

The federal corporate income tax by contrast has a marginal bracketed corporate income taxNew. Estimated Local Business tax. Financial advisors can also help with investing and financial planning - including.

Forming an S-corporation can help save taxes. We Are the Only Solution Available to File S-Corp Election Paperwork Online. From the authors of Limited Liability Companies for Dummies.

Annual cost of administering a payroll. Total first year cost of S-Corp. An S corporation S Corp Subchapter S corporation under the IRS code is not taxed at the business level because it is a pass-through tax status for federal state and local.

COVID-19 is still active. Our small business tax calculator has a separate line item for meals and entertainment because the IRS only allows companies to deduct 50 of those expenses. New Jersey has a 6625 statewide sales tax rate.

1973 Sharp Calculator Advertisement Newsweek April 16 1973 Advertising Old Ads Vintage Advertisements

Should You Choose S Corp Tax Status For Your Llc Smartasset

Fringe Benefits Rules For 2 S Corp Shareholders Cares Act Changes

S Corp Tax Savings Calculator Newway Accounting

What To Do If Your Business Missed The S Corp Tax Deadline

Pin By Crystal Tax Inc On Crystaltaxinc Com Separation Income Tax Names

S Corp Vs Llc Difference Between Llc And S Corp Truic

S Corp Tax Savings Calculator Newway Accounting

S Corp Vs Llc Difference Between Llc And S Corp Truic

S Corporation Tax Calculator S Corp Vs Llc Savings Truic

Should You Choose S Corp Tax Status For Your Llc Smartasset

S Corp Vs Llc Difference Between Llc And S Corp Truic

How To Start A Corporation Legalzoom Com

Avoiding Gain At The S Shareholder Level When A Loan Is Repaid

S Corp Vs Llc Difference Between Llc And S Corp Truic

Why Convert Your Tax Status From S Corp To C Corp Harvard Business Services

Llc Tax Calculator Definitive Small Business Tax Estimator

S Corp Vs Llc Difference Between Llc And S Corp Truic

Can I Convert My Llc To An S Corp When Filing My Tax Return Turbotax Tax Tips Videos