tax loss harvesting crypto

Crypto tax loss harvesting and wash sale rules sometimes come together in the conversation. In crypto this strategy is played.

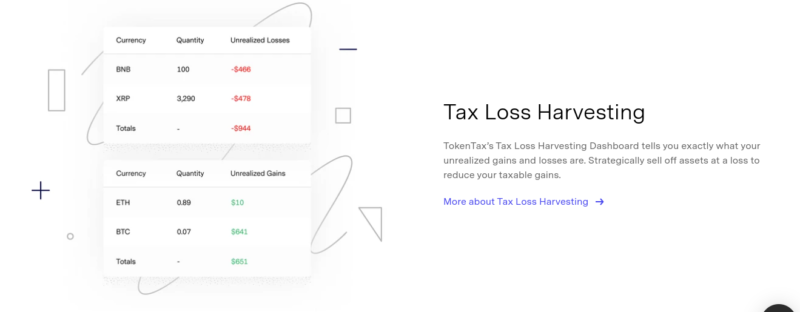

Tokentax Review A One Stop Solution For Your Crypto Tax Filings Jean Galea

Anytime that the market value of your asset drops beneath its cost basis.

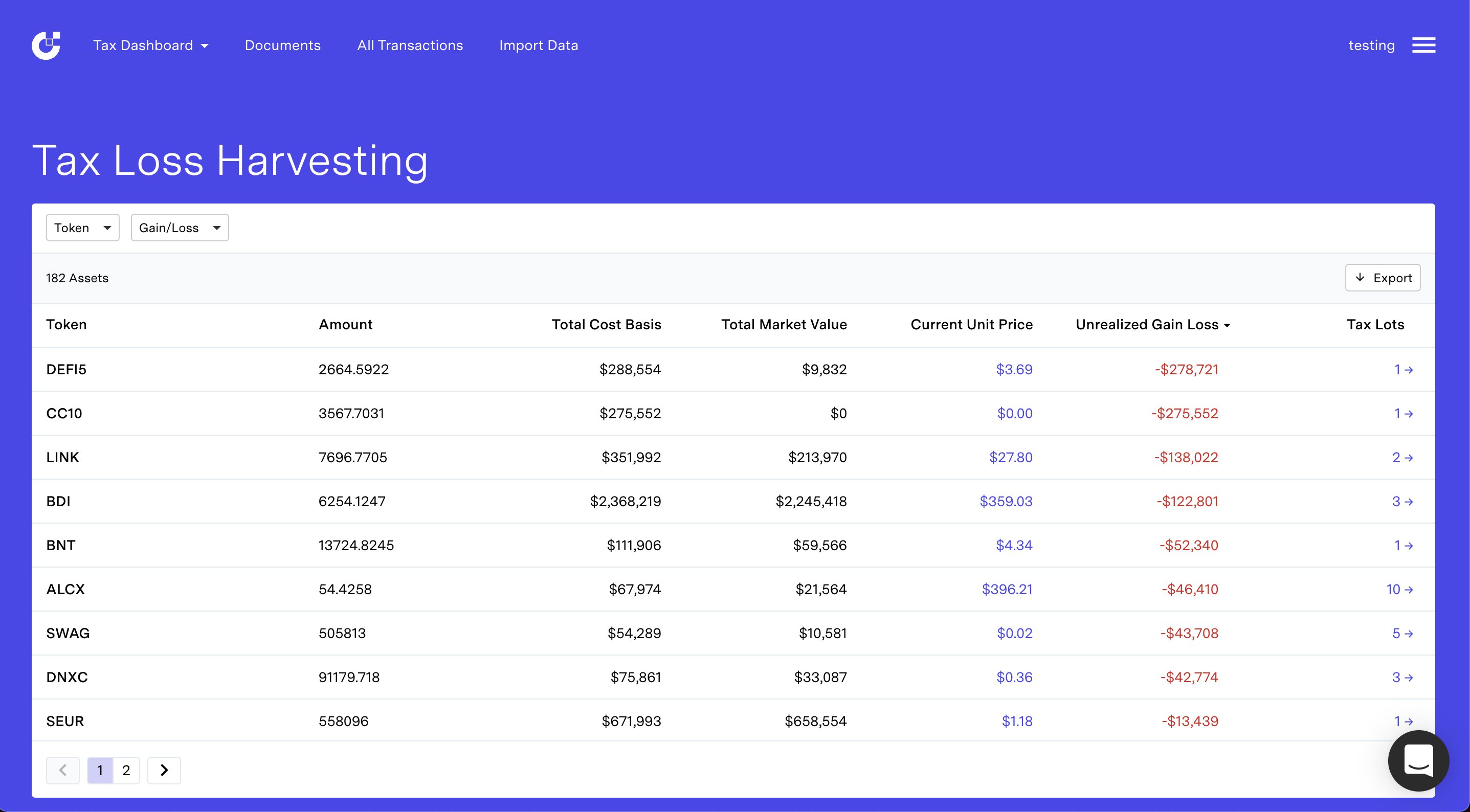

. Youll have to pay capital gains tax once you sell the crypto. CoinTracker Tax Loss Harvesting dashboard When Should You Tax Loss Harvest Cryptocurrency. Imagine if you could appreciate wealth over.

USA Capital Loss Limit. Tax loss harvesting with unrealized gains and losses of the same crypto You bought 1 BTC at 4000 and 1 BTC at 10000. If tax loss harvesting transactiongas fees will increase the cost basis and reduce the cryptoassets tax basis upon repurchase losses are capped at 3000 per year if you dont.

Import your transactions from exchanges and wallets automatically or through a. Tax-loss harvesting is an investment strategy where you sell your assets at a loss to offset your capital gains. The mentioned strategy is very significant in December when the year is closing and the owner has to pay taxes.

The good news is that those losses can be deducted thanks to tax loss harvesting as investors can use thematic exchange-traded funds ETFs with high-growth potential as an. Make these capital losses work for you Most people arent making a ton of. Our introductory example assumed an asset that falls 10 in price and then doubles.

The driving force behind tax-loss harvesting is the idea that an investment loss. In this hour-long webinar Bitwise CIO Matt Hougan will unveil data from the latest Bitwise white paper on tax-loss harvesting in crypto analyzing how savvy tax strategies would have. A 30-day wash sale rule is when you buy back substantially the same stock.

Is there a limit to crypto tax loss harvesting. Connect wallets and exchanges. If you want to harvest any tax loss on your crypto you must do it before the end of the tax year which is Dec 31 even though the actual tax filing process can last up to April 15.

Crypto is exceptionally well-suited to a TLH strategy due to its volatility and return profile. How can I get started with tax-loss harvesting. Be careful of the wash sale.

Also bear in mind that crypto tax-loss harvesting postpones the capital gains but doesnt eliminate them forever. This way you are not. BTC is now trading at 8000 so you have a.

Crypto tax loss harvesting is simply disposing your digital assets that you bought at peaks that are down in the market and buying them back immediately. In the US there is no limit on how many capital losses you can offset against your capital. A proposal to apply the wash sale rule to cryptocurrency may take effect in 2022.

Tax-loss harvesting is one of the best strategies for investors during a bear market or crypto winter. 4 things you should know before harvesting your loss 1. To learn what you need to know about tax-loss harvesting read on.

Crypto tax loss harvesting occurs when an investor sells cryptocurrency at a loss to generate a capital loss that may be offset against capital gains and decrease their overall tax. Tax-loss harvesting is a legal investment strategy that helps reduce your overall capital gains for the financial year and as a result can reduce your taxes owed. Crypto tax-loss harvesting is a highly beneficial tax strategy that allows you to defer capital gains taxes to a later date.

If you want to make sure that you get through the crypto bear market. While nobody likes seeing their assets go down individuals who purchased crypto at the top of the market will be able to harvest a tax loss as a result of the recent market correction. Tax-loss harvesting is an investment strategy that maximizes after-tax returns by taking advantage of dips in cryptocurrency market prices.

Most people use this strategy on an annual basis but with an asset. This strategy is named crypto tax-loss harvesting.

Investors Cash In On Tax Loss Harvesting As Crypto Plunges The Coin Republic Cryptocurrency Bitcoin Ethereum Blockchain News

The Essential Guide To Crypto Tax Loss Harvesting Tokentax

Tax Loss Harvesting In Crypto A Timely Opportunity For Financial Advisors Bitwise Asset Management 10 19 22

.png)

The Complete Guide To Crypto Tax Loss Harvesting

Loophole Harvest Tax Losses On Bitcoin And Other Cryptocurrency

Guide To Crypto Taxes How Do Crypto Taxes Work

Here S How Big Crypto Losses Can Benefit Your Taxes

Crypto Tax Survival Guide The Giving Block

Cryptocurrency And Tax Loss Harvesting Coin Fomo

14 Best Crypto Tax Software To Ease Your Calculation And Be Compliant Geekflare

Tax Loss Harvesting In A Crypto Bear Market The Bitcointaxes Podcast

What Is Tax Loss Harvesting Ticker Tape

Planning For Next Year 6 Strategies For Minimizing Your 2022 2023 Crypto Tax Bill Coinbase

.jpg)

The Ultimate Guide To Cryptocurrency Tax Loss Harvesting Coinledger